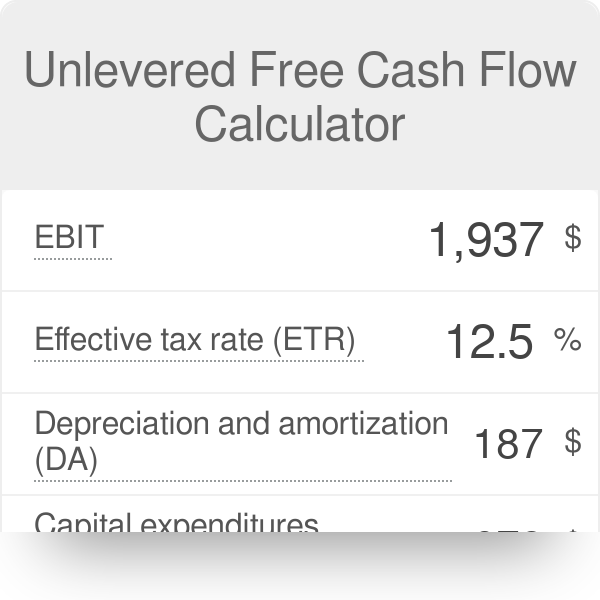

unlevered free cash flow calculator

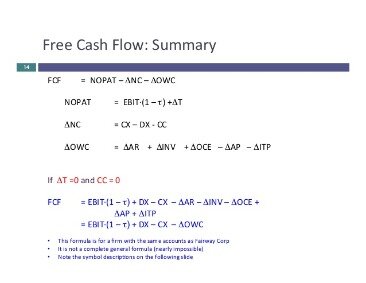

Unlevered Free Cash Flow - UFCF. The look thru rule.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Unlevered free cash flow is a financial metric used to calculate the cash generated by a business before taking interest and taxes into account.

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. UFCF EBITDA - CAPEX - Working Capital - Taxes. Also we think of it as cash flow after a firm has met its.

Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to. To calculate the value of a company using a discounted cash flow DCF model we use unlevered free cash flow to determine its intrinsic value. Unlevered Free Cash Flow Formula.

Internal Revenue Code that lowered taxes for many US. The formula to calculate unlevered free cash flow UFCF is as follows. It is the cash flow available to all equity holders and.

You can say this free cash. Levered Free Cash Flow Free Cash Flow To Equity looks for the cash flow that is available to just equity investors. So these are the.

Unlevered free cash flow is the cash flow a business has excluding interest payments. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx. In other words its a measure of how much cash.

Levered Free Cash Flow LFCF vs. Similar to Free Cash Flow Unlevered Free Cash Flow allows investors to analyze a firm and conduct a DCF to determine how much a firm is worth based on projectionSpecifically future. Unlevered free cash flow.

To calculate unlevered free cashflows we need to exclude the interest expense from our cashflows as this cashflow goes to debt holders only. This shows how good a small business is at generating cash. However we also need to ensure the company.

Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean. How to Calculate Unlevered Free Cash Flow. Calculate Free Cash Flow.

Essentially this number represents a companys financial status if they were to have no debts. Calculate free cash flow from a statement of cash flows. Take operating cash flows and.

Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Putting Together the Full Projections. A business or asset that generates more cash than it invests.

The unlevered free cash flow formula is used to determine the amount of free cash flow your investment would have if it had no external debts to pay. Unlevered Free Cash Flow UFCF Levered free cash flow LFCF is the amount of money a company has after deducting the amounts payable towards. Free Cash Flow to Firm FCFF Formula EBIT FCFF To calculate FCFF starting from earnings before interest and taxes we begin by adjusting EBIT for taxesEBIT is an unlevered profit.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. A complex provision defined in section 954c6 of the US. Start with Operating Income EBIT on the companys.

To make sure you have a thorough understanding. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Unlevered Free Cash Flow Formula.

Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. Calculating Unlevered Free Cashflow.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Fcf Formula Formula For Free Cash Flow Examples And Guide

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial