kern county tax collector payment center

This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Property Taxes - Pay Online.

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Crime Non-Emergency Domestic Violence.

. Credit cards and debit cards have a 2 card processing fee based on the amount of taxes paid. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments. Kern County Business Recruitment Job Growth Incentive Initiative.

Box 541004 Los Angeles CA 90054-1004. The first installment is due on 1st November with a payment deadline on 10th December. Here youll find many opportunities to learn Kern Countys story through digital content news releases community events and updates from our departments.

Use our online tool to check for foreclosure notices and tax liens on a property. Kern County Treasurer-Tax Collector mails out original secured property tax bills in October every year. Box 541004 Los Angeles CA 90054-1004.

3 Via the treasurer-tax collectors website at wwwkcttccokerncaus. Do not include correspondence with your payment. The office is located at 1115 Truxtun Ave.

Interest Apportionment - Fund Number Search Interest Apportionment for Quarter Ending September 30 2021. Fraud Waste and Abuse in Kern County Government. KCTTC Payment Center PO.

Check out our new site for information about Kern County government. Child Abuse or Neglect. Box 541004 Los Angeles CA 90054-1004.

Property Taxes - Pay Online. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate transaction will be charged. The release urges residents to use alternative methods of payment if possible including paying online at wwwkcttccokerncaus or mailing checks to KCTTC Payment Center PO.

Electronic Checks ACH can be used for on-line payments with zero fees. Tax payments only must be mailed to. 1 Via mail to.

The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment. If your tax bill is not available please provide your Assessor Tax Number or an adequate legal description along with your payment. The Kern County Treasurer-Tax Collectors Office located in Bakersfield California is responsible for financial transactions including issuing Kern County tax bills collecting personal and real property tax payments.

A Notice of Supplemental Assessment relates to a new assessment resulting from a change in ownership or new construction. If your tax bill is not available please provide your Assessor Tax Number or an adequate legal description along with your payment. Welcome to the Kern County online tax sale auction website.

Secured tax bills are paid in two installments. Box 541004 Los Angeles CA 90054-1004. Due to COVID-19 the public is encouraged to obtain a money order and mail it to the address above to avoid in-person payments.

Child Abuse or Neglect. Kerr County Tax Office 700 Main Street Suite 124 Kerrville Texas 78028 Phone. The Kern County Treasurer and Tax Collectors Office is part of the Kern County Finance Department that encompasses all financial functions of the local government.

Do not include correspondence with your payment. Tax payments only must be mailed to. The Kern County Treasurer-Tax Collector is committed to providing quality services to the public.

The property tax deadline is May 4 and penalties will apply beginning May 5. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Property Taxes - Pay by Wire.

Fraud Waste and Abuse in Kern County Government. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. Via the Treasurer-Tax Collectors website at wwwkcttccokerncaus.

The 2 processing fee is the same whether you pay on-line or in person. Correspondence must include the Assessor Tax Number. A 10 penalty is.

DeedAuction is part of our offices. Crime Non-Emergency Domestic Violence.

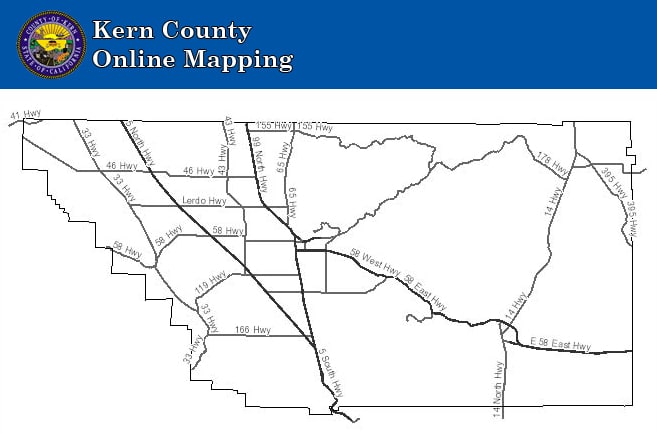

Interactive Maps Kern County Planning Natural Resources Dept

Board Of Directors United Way Of Kern County

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Events Kern County Taxpayers Association

Kern County Treasurer And Tax Collector

What Does Kcttc Mean Definition Of Kcttc Kcttc Stands For Kern County Treasurer And Tax Collector By Acronymsandslang Com

Kern Delta Water District Water Association Of Kern County

Supervisorial District 1 Map Kern County Ca

Kern County Treasurer And Tax Collector

County Tax Bills Mailed To Property Owners News Bakersfield Com

Kern County Treasurer And Tax Collector

Kern County Property Taxes Due Next Week Kget 17

Jordan Kaufman Kern County Treasurer Tax Collector Facebook